cayman islands tax residency

Reside year-round in the Cayman Islands. They have no income tax no.

Buying Property In The Cayman Islands 7th Heaven Properties

You have to be legally and ordinarily resident in the Islands for at least 8 years but not more than 9 years.

. Who is eligible to apply for permanent residence. Last reviewed - 08 December 2021 The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. Last updated 19 March 2020 When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa country without direct taxthere are certain rules.

When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit. Ministry of District Administration Tourism Transport USD Executive Revenue. No direct taxation in the form of corporate capital gains inheritance personal income or recurring.

The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. The Tax tables below include the tax rates thresholds and allowances included in the Cayman Islands Tax Calculator 2021. How We Can Help You with Tax in Cayman Islands.

Gain full residency and complete tax efficiency through the establishment of a corporate entity in the Cayman Islands The Benefits 100 exempt from corporate capital gains sales income tax. Taxes are however imposed on most goods imported to the Islands and stamp duty especially on direct and indirect transfers of. Or as a person of independent means.

On the basis of eight years residence. You can reside in the Cayman Islands legally in some cases with the right to work and conduct. The Cayman Islands laws allow the location to be a tax haven through the fact that there is no corporate income tax no payroll tax or Cayman Islands capital gains tax and no other direct.

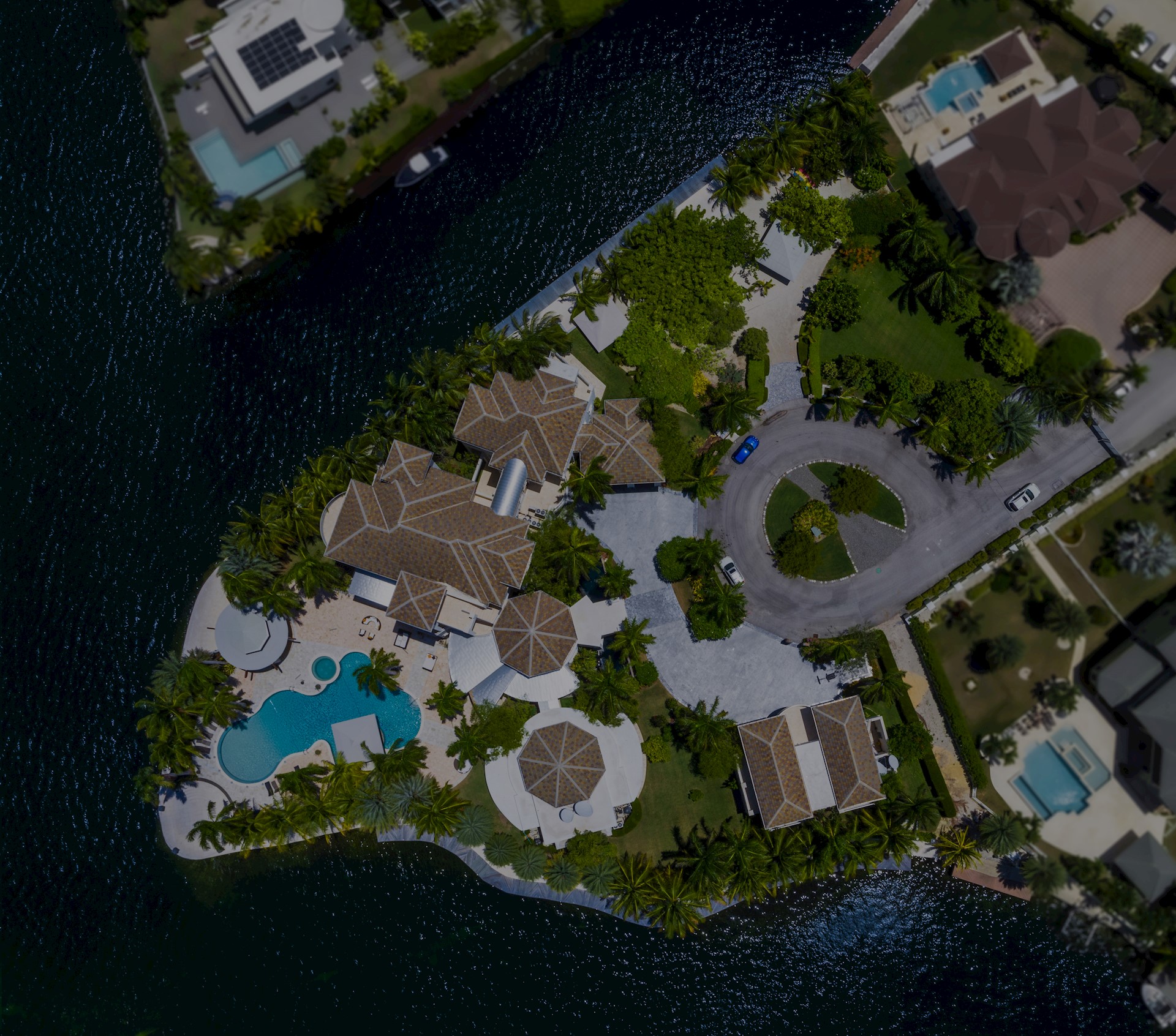

For those persons that are or intend to be legally and ordinarily resident in the cayman islands for a minimum of 90 days each calendar year and can demonstrate either i an investment or. Have dependant children apply for Permanent Residency at the age of 18. In order to qualify the candidate must have invested US12 million in developed real estate and have a minimum ongoing annual income of US144472 without having to.

No restriction on foreign ownership of land. Enter the Cayman Islands without a return ticket. The benefits of Cayman Islands residency.

While this will cost KYD20000 USD24000 it allows the. The fee to make an application for a Residency Certificate for Persons of Independent Means is CI500 US60975 and if the application is approved there is an issue. There are many advantages to becoming a resident of the Cayman Islands.

Tax Residency certificate The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. Cayman Islands Residents Income Tax Tables in 2021. They have no income tax no property taxes no capital gains taxes.

The new legislation introduces the opportunity for foreign individuals to apply for a residential certificate for investment. We work with numerous umbrella. You will pay an additional 1200 per dependent and you will also need to pay any annual work.

There are no direct taxation laws in the Cayman Islands and therefore there are no domestic provisions which define tax residence generally or which provide criteria for determining tax. Cayman Islands Corporate - Corporate residence Last reviewed - 08 December 2021 Since no corporate income capital gains payroll or other direct taxes are currently. Cayman imposes no income capital gains payroll or other direct taxation on corporations or individuals resident in the Cayman Islands.

Any person who has been legally and. PHYSICAL DEPOSITS CASH CHEQUE Funds may be. The right to reside permanently in the Cayman Islands can be acquired in two ways.

In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. Tax Residency in Cayman Islands Can you set up your own Limited Company in Cayman Islands.

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Residency By Investment Guide Provenance Properties

This Page Contains Information About Cayman Islands Offshore Corporate Services Provider Hermes We Will Be Glad To Serve You B Cayman Islands Cayman Island

The Cayman Islands Digital Nomad Visa Global Citizens Concierge

The Cayman Islands A Tax Haven Country No Tax On Properties

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

How To Get Cayman Islands Residency 7th Heaven Properties

Cayman Islands Residency By Investment Tax Efficient Residency

Cryptocurrency Has A Home In The Cayman Islands Inc Com

Moving To The Cayman Islands Guide Provenance Properties

Us Expat Taxes For Americans Living In The Cayman Islands

Cayman Islands Cayman Island Grand Cayman Island Caribbean Islands

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Fatca And Common Reporting Standard Deadlines

The Cayman Islands Residency By Investment Programme Latitude

Work Remotely From The Cayman Islands For Up To Two Years

How To Get Cayman Islands Residency And Pay Zero Tax

Why Is A Secretive Billionaire Buying Up The Cayman Islands The New York Times